Equal law for all!

The legal protection insurance takes over in an insured legal dispute u.a. the costs:

- of your lawyer according to the German Lawyers' Fees Act (RVG)

- the opposing lawyer, if you have to bear them as a result of the judgment

- of the correspondence lawyer abroad, if this is required due to the jurisdiction abroad and the distance to your place of residence

- for the penalty deposit (if set) in the context of an interest-free loan

- for court-ordered expert opinions

- the costs which are set by the court for the procedure

The major cost points are therefore covered by the legal protection insurance and the financial fears are thus hopefully passe.

How is the legal protection insurance structured?

In principle, the legal protection insurance defines the insured legal disputes, e.g.B. Disputes in contract and property law, tax law, etc.. In addition, legal protection is divided into four areas that you can put together individually:

- Private area, the basic building block

- professional field, in case of disputes with the employer

- Traffic area, in the case of disputes on the road even outside the car (z.B. as a pedestrian, cyclist, public transport, etc.)

- Real estate, in case of disputes related to the owner-occupied apartment z.B. with the landlord, neighbors or the municipality

Whether insurance cover exists therefore depends on whether the affected area is insured and the dispute is one of the insured service contents.

Does the insurer also pay for out-of-court dispute resolution?

About the legal protection is i.d.R. also the extrajudicial activity of the lawyer is covered, with the exception of certain services (e.g.B. tax legal protection before German courts). Newer legal protection concepts also include the assumption of costs for mediation proceedings.

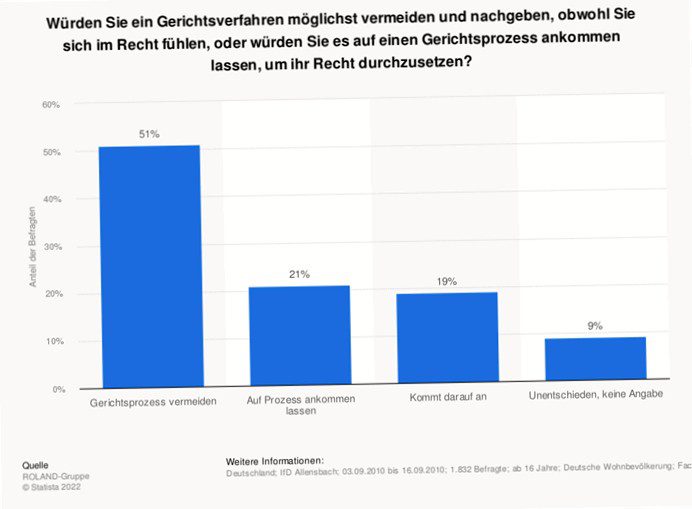

You can find more statistics at Statista

As shown in the ROLAND Group survey, a large proportion of the people surveyed would like to resolve legal disputes out of court. Mediation is a great solution here, especially for disputes with people with whom there is a closer relationship z.B. the employer or neighbor. In mediation, a mediator sits down with the two parties, clarifies the legal situation and tries to reach an out-of-court solution. This dispute resolution often avoids expensive and lengthy court cases, instead finding a solution that both parties agree on.

If you would like to find out about your rights before a legal dispute arises, you can contact most insurers for legal advice by telephone. Here you describe your concern to a lawyer, who gives you a realistic assessment of the legal situation and evaluates the chances of success of further proceedings.

Special features of different tariffs

The tariffs on the market differ only slightly from each other at first glance, but there are certain benefits by which the insurers clearly distinguish themselves. When selecting legal protection insurance, you should therefore pay particular attention to the following benefits:

In legal protection insurance, criminal law is covered in principle, but the insurance coverage does not apply in the event of an accusation of intent. Through the co-insurance of the extended criminal legal protection, the insurer also pays if the charge is intentional. However, if you are convicted of intent, you are obliged to repay the benefit.

In very old legal protection tariffs, disputes in connection with almost all investments were also covered. However, since this area has often led to claims, insurance coverage is now almost exclusively limited to low-risk investments (savings accounts, state-subsidized pension plans, etc).) have been limited. However, there are some concepts that also cover this area extensively.

Lawsuits regarding the awarding of a university place are very rarely found in today's concepts, but there are still tariffs that offer solid insurance protection for this as well.

Disputes in connection with family and inheritance law are limited in most legal protection concepts to a one-time consultation or. limited to a small reimbursement. With some concepts, a higher level of coverage is also possible.

Divorce and alimony

For divorce and alimony disputes, the same rules usually apply as for inheritance law; if you want more extensive insurance coverage, you can select this as an additional module with certain providers.

Legal protection insurance generally excludes disputes in connection with the construction of real estate requiring a building permit. There are certain providers who insure this risk with a sub-limit or. who offer their own legal protection for this purpose.

With certain tariffs you receive a one-time benefit, which is made available to you with the preparation of a living will and/or health care proxy (partially also will).

In principle, legal protection insurance excludes all disputes that have their origin before the start of the legal protection contract. In some tariffs, however, these disputes are also insured if you have been insured there for a certain time (usually 5 years).

Example: you take out an occupational disability insurance policy in January 2015 and your legal protection insurance policy in March 2015. In July 2020, you become unable to work and apply for benefits from your occupational disability insurance company, but it rejects the claim because you are alleged to have failed to answer a health question – which is causally related to your occupational disability – truthfully. Without the inclusion of pre-contractuality, there is no insurance coverage through your legal protection insurance, with the inclusion there is, since you have already been insured there for 5 years.