How does the German student finance himself?

Financing your studies: part-time job or your parents? As a research assistant or through reserves? How do German students finance themselves and how much money do they have to get by with each month?? Information on the subject, tips and alternative financing can be found here.

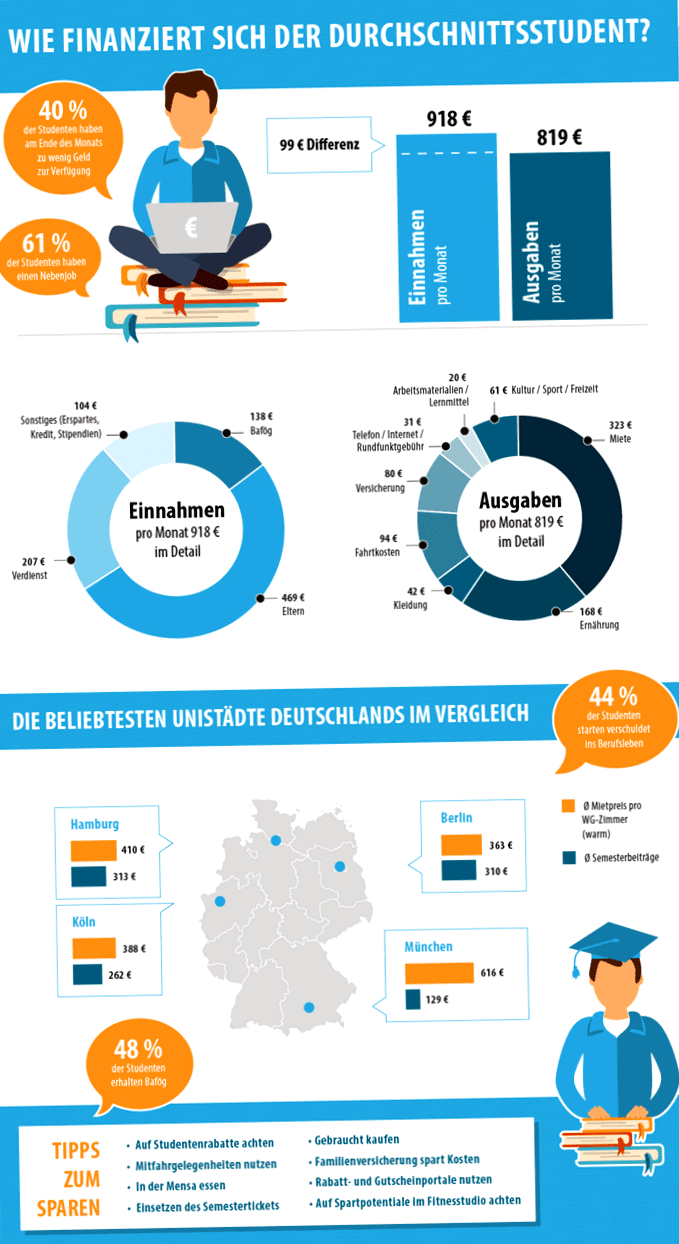

The "lazy student" is a prejudice that unfortunately still persists in some people's minds, although it should have been a thing of the past long ago. The figures that speak against this picture start with the more than 60% of all students who work while studying and end with the 40% of all students who still do not have enough money left at the end of the month. A compensation that more and more students use is that they apply for a loan.

The German Federal Ministry of Education and Research regularly publishes a report on the economic situation of students, from which we have compiled the most interesting facts here.

The cost factors of student financing

A big problem with financing college is that the biggest cost in the vast majority of college towns keeps growing: rent. About 40% of the money has to be paid for rent every month, with Munich being the most expensive student city in Germany with an average rent of 600€.

Working part-time prolongs studies

In addition, working while studying is an additional burden to studying for exams and attending seminars. As a result, a significant difference in study time develops between students who are required to work while studying and those for whom this is not necessary.

Just because today more than ever a young entrance into the professional world is demanded and the study should be completed if possible in regular study time, an unfair imbalance develops here. Some students seek an alternative by applying for a loan, for example. This means that either the additional earnings can be completely replaced by a part-time job or at least fewer hours of work are required per week.

Tips for saving money during your studies

In addition to many problems in the study, as far as money is concerned, students of course also have many advantages. Those who know how to take advantage of student status can save money in a great many places in an attempt to combat the budget gap at the end of the month.

1. Student discounts

In no situation in life, except perhaps during retirement, do you get special offers and discounts in as many places as you do as a student. Especially the cost factor leisure and culture can often be drastically reduced here. Whether you go to the cinema, the theater or the open-air swimming pool, you should always have your student ID with you to take advantage of the sometimes substantial discounts.

2. Cheaper catering

While cooking yourself is always the cheapest and in most cases also the healthiest, you can also get away very cheaply in most university dining halls.

3. Travel expenses

Travel costs actually make up a relatively large part of the costs of financing studies on average. Therefore one should use the semester ticket in the study as wisely as possible. Let's take Dusseldorf as an example: here you get the NRW ticket during your studies. If you want to go to Berlin, for example, you can probably save part of the travel costs if you first travel to Bielefeld for free with the NRW ticket and only pay for the rest of the trip from there.

Debt-ridden entry into working life

After 3, 5 or more years, the study is finally completed. Months in the library, facing term papers or pages of formulas, pure stress before oral exams and hundreds of lectures and seminars. In most cases, a part-time job, and still just enough money to live on. But it all paid off. Finally, the job search can begin, hopefully with good chances due to the studies.

And in 44% of all students with debts that run into the thousands. Sad but true, among the "rewards" of studying in many cases is first being allowed to pay off a mountain of debt, either through BAfoG or some other form of student loan.

In most cases, however, loans to finance studies have relatively tolerant conditions as far as repaying the loan is concerned. So you don't have to pay everything back immediately after graduation, but can take your time and pay off the loan when you are working and earning money.

Conclusion to study financing

Financing studies in Germany is much easier than in the U.S., but even here many students have to take out a loan or work part-time. As a prospective student, you have to ask yourself whether you are willing to put your studies on the back burner in order to get a job or whether you would rather pay back a loan at the end of your studies.

More about motivation & information

We are not just one, but many! Our experienced team will support you in all financial matters relating to your studies. You have questions about our contributions? Then contact us, we will be happy to help you further.