Interest rates 2016: what to expect

In late 2015, the Federal Reserve decided to raise interest rates for the first time in nearly a decade. Right now, interest rates are expected to increase several more times this year and this trend will likely continue for years depending on economic factors.

But thanks to uncertainty about the strength of the global economy, the Dow Jones Industrials and S&P 500 are down more than 6% at the time of writing. There is concern that these higher interest rates come at a time when the economy can't handle them, which could lead to slower growth in the U.S. and fewer jobs – just when the job market has shown some signs of strength.

4 "inflation-proof" stocks to buy today! No doubt, inflation is soaring. Investors are unsettled. Money just sitting in the bank loses value year after year. But where should you invest your money? Here are 4 stock favorites from The Motley Fool's editors that you can invest in as inflation rises. We have some of the most profitable stocks of this generation like Shopify (+ 6.878%), Tesla (+ 10.714%) or MercadoLibre (+ 10.291%) recommended early on. Hit these 4 stocks while you still can. Just enter your email address below and request this free report immediately. Request the free analysis now here.

FEDERAL RESERVE CHAIR JANET YELLEN LOOKS SET TO USHER IN A NEW PERIOD OF RISING INTEREST RATES.

What can Americans expect? It's not an easy question, nor one with an obvious answer. Here's a closer look at what it all means and how it might affect you.

How interest rates work

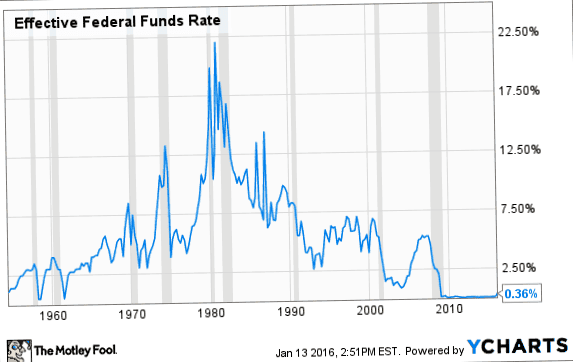

The Fed does not control the interest rates that customers pay on credit cards or loans, or what interest they receive on their savings deposits. But it controls the prime rate (the federal funds rate or Fed rate), which is related to all these interest rates. The prime rate is the interest rate banks pay each other for short-term loans.

FEDERAL RATE. DATA FROM YCHARTS

In other words, this is the interest rate at which much of the economy operates, as it affects the cost of capital for the entire banking sector. Try to see it this way:

When a bank lends capital at this rate, it receives interest based on the Fed's rate. The higher this rate, the more the bank gets and vice versa. This also affects consumers because it helps determine the interest rates they receive on their savings, checking accounts, certificates of deposit and other fixed-rate investment products.

It works the same way when you borrow money. You have to pay interest to get that money, so the bank has to charge a higher interest rate to cover the interest on the debt and its own costs to make a profit.

What this means for you?

The cost of capital paid by banks and their borrowers has been at historically low levels for the past seven years. This means cheaper mortgages and loans to buy cars, but also lower interest rates on savings.

This has also led to lower interest rates on corporate bonds, which has been both good and bad. The good thing is that businesses have had access to cheaper capital to expand their operations, hire new employees and do other things to boost business. At the same time, many companies have also been using that money for things like dividend payments and share buybacks, giving investors a one-time, but not necessarily long-term, benefit.

The bad thing is that lower interest rates also mean lower yields, which is bad for fixed-income forms of income. As many baby boomers approach retirement or are already retired, it may also affect their income in retirement.

So far, the increase in prime rates has caused mortgages and credit card interest rates to become more expensive, while interest rates on savings have yet to rise. There are two reasons why this is the case. Creditors have to recoup the higher costs, so you see the interest on debt rising faster. But since the Fed rate is still at a very low level – between 0.25% and 0.5% – there is little room to increase interest rates on savings deposits.

Difficult to predict

The Fed is likely to raise interest rates even further this year. Investors who invest in futures have overwhelmingly put their money on a March rate hike. They also expect the Fed rate to be 1% by the end of the year. That might still be conservative: The FOMC (the committee that controls Fed policy) has projected a median interest rate of 1.4% through the end of the year.

At the same time, there is concern about the state of the global economy. Fears of economic weakness in Asia – especially China – are key factors behind the weakness in U.S. stocks at the beginning of the year. But the implications are much broader. China, as the world's second largest economy, is both a major supplier and a major consumer, If China grows slower – or faster – than expected, that could also have an impact on the U.S. economy and slow the rate hike.

And while that would be good for borrowers, for savers it would mean that low interest rates will continue like this.

A look into the future: rising interest rates would be a good sign

If the Fed manages to raise interest rates further this year, that would be a good thing. Yes, debtors would pay more on their credit card debt, on their house and on their car, while seeing little difference on their savings balances. But the Fed is unlikely to raise rates unless the U.S. economy also remains strong, there are more jobs and income growth is steady. Even if interest rates rise according to FOMC projections, consumers would still have access to the cheapest capital in American history.

If interest rates hardly rise this year, it would be a bad sign for the economy.

There is one company whose name is currently coming up very, very frequently among analysts at The Motley Fool. It's THE top investment for us for 2022.

You could benefit from this as well. To do this, you first need to know everything about this unique company. That is why we have now compiled a free special report that presents this company in detail.