The best credit card for South Africa (2022): withdraw money for free in South Africa and save money!

With the right South Africa credit card you can save a lot of money during your trip and at the same time have a clear conscience. Hardly anyone feels particularly comfortable in a foreign country with bills spilling out of their wallet or having to hide them in their hotel room.

We traveled through South Africa ourselves for two months, during which time we tried out numerous banks and also paid in several accommodations, restaurants and stores with our travel credit cards.

In this article, we would like to present our personal recommendations and describe our experiences, which we gathered during our trip through South Africa. We also go through the most frequently asked questions about credit cards in South Africa and give you more tips to help you withdraw money for free.

Important requirements for a South Africa credit card

- free withdrawals in South Africa or. worldwide possible

- free foreign withdrawals (d. h. payment abroad is free of charge)

- Credit card free of charge

- no annual fee

- A modern, simple and travel-friendly TAN procedure

- friendly, helpful and fast customer service

- comfortable and travel-suitable smartphone app

Before we started our South Africa trip, we used these criteria to compare several credit cards with each other and thus selected the optimal South Africa credit card.

Comparison table of South Africa credit cards

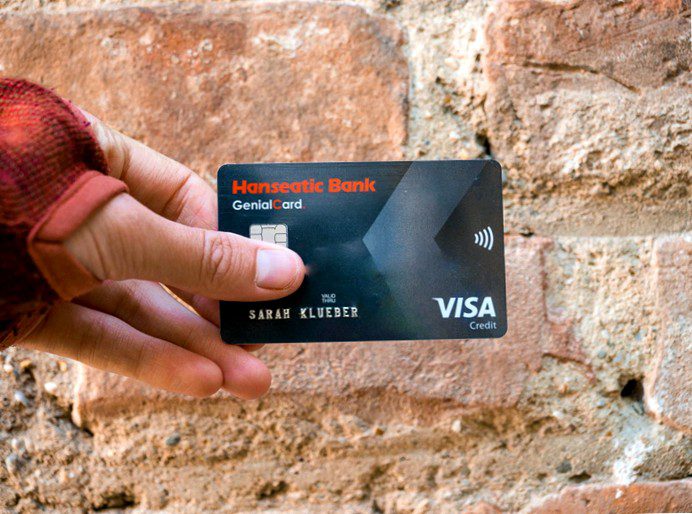

In this section, we will now compare two credit cards with which we ourselves travel and which we can recommend to you 100%. This is on the one hand our favorite, the Hanseatic Genial Card*, and on the other hand the Barclaycard, which we always carry with us as a substitute credit card.

(On the smartphone the table can be moved from left to right.)

The best credit card for South Africa: Hanseatic Genial Card

Our first choice is and remains the Hanseatic Genial Card, which we use worldwide on our travels. With this travel credit card, we have had advantages in every country so far, which we unfortunately could not enjoy with other credit cards.

The most important advantages

- Cash withdrawal is free of charge worldwide.

- The issuance of the card is free of charge.

- No annual fees are due.

- Payment is possible free of charge without additional fees. This means that no foreign transaction is due.

- The credit card can also be applied for individually and thus without a current account of the Hanseatic Bank. You must then specify another account from which the amounts will be debited.

- Withdrawal limit of 500 € per day

- User-friendly, easy to understand app

- Payment with Apple Pay possible

- Bonus: 15% cashback in over 300 online stores

The disadvantages

- Foreign fees are unfortunately not refunded (unimportant in South Africa).

- High debit interest rate of 12.82% for unpaid credit card bills.

TAN procedure of the Hanseatic Bank

Hanseatic Bank offers two TAN methods: pushTAN and photoTAN. Both are perfect for travelers!

With pushTAN, a TAN is sent to your smartphone via the Hanseatic Bank app. With photoTAN, you have to scan a colored QR code with the Hanseatic app to do your online banking. The QR code is then converted into the respective TAN number.

Partial payment procedure

The Genial Card is accepted as a full Visa Card worldwide. The credit card statement is deposited in your online banking every month. However, there is a small catch: Only three percent of the invoice amount due is automatically deducted from your account. The remaining 97 percent you have to transfer to the credit card yourself instead.

Sounds annoying? It is also! However, you can completely switch off this so-called installment facility in online banking. Afterwards, the entire amount of your credit card statement will be collected automatically and you don't have to transfer money on your own anymore.

Application

- Video-Ident: A bank employee identifies you via webcam

- Post-Ident: You have to go to a post office branch and be identified by an employee there.

The bank then checks all your details. As soon as the application is approved, it will only take a few days or weeks until you finally have your South Africa credit card in your hands.

Alternative & Backup: Barclaycard

We always carry the Barclaycard, which is also free of charge, with us as a substitute credit card. It is practically our protection in case the Genial Card does not work, is stolen or lost. The credit card only works in combination with a current account.

The main advantages

- The credit card is completely free of charge.

- There are no annual fees.

- Withdraw cash worldwide free of charge

- Paying worldwide free of charge (no foreign transaction fee).

- Barclaycard can be applied for individually and without a checking account.

- You get a starting credit of over 50 € when you open your account.

- Students can also apply for the Barclaycard

- Mobile payment with Apple Pay or Google Pay is possible.

- Withdrawal limit of 500 € per day

- User-friendly, easy-to-understand app

Disadvantages of the credit card

- Third-party fees are not reimbursed.

- The credit card can only be used in conjunction with a current account (which is not necessarily a bad thing).

- Only mobileTAN procedure possible.

TAN procedure

- mobileTan: The required TAN is sent via SMS to your stored cell phone number.

Application

You can also easily apply for the Barclaycard online. You can choose between the two identification methods already explained:

Foreign fees in South Africa

In some countries such as Thailand, Australia or Vietnam, the local banks charge foreign fees as soon as you withdraw money with your travel credit card. Fortunately, these fees do not exist in South Africa!

But what happens if you travel to another country with foreign fees? Then you have to bite the bullet and put up with them. Unfortunately, there is currently no good travel credit card available that will reimburse these fees. Banks such as comdirect, DKB or Santander used to offer this service, but have since discontinued it.

Pack a spare credit card!

It doesn't weigh much and offers more security than risk: the replacement credit card! In our eyes it is at least as important as your main credit card.

Unfortunately, most people only think of theft, but there are several situations in which a replacement card can be helpful. We have experienced that only one of our two credit cards is accepted by some ATMs. Sometimes a card has been withdrawn from an ATM for no reason at all and not spit out again. In these cases we have always been grateful for our second card.

Tip: Speaking of theft, we advise you to store the replacement card separately from the main card. Should your wallet really get stolen or lost, you still have an ace up your sleeve.

Security: Using the South Africa credit card correctly

Replacement credit card all well and good – nevertheless, it is usually not much fun when one of the credit cards goes down or is blocked. What you should look out for in South Africa to avoid taking risks, we have summarized for you in this section.

Credit card fraud in South Africa

Credit card fraud is not a national phenomenon, but something you should watch out for worldwide. The fraudsters either scan the data of your card (e.g. the. B. (credit card number, IBAN and CCV) or read the PIN when entering it. This is done via hidden cameras, glued-on fake keyboards or separately attached card readers.

- We check the keypad and the card insertion module of the respective bank machine.

- During PIN entry, we cover the keypad from view.

- We only withdraw cash from ATMs belonging to banks, supermarkets, gas stations or shopping malls.

- We completely avoid ATMs that are located on the side of the road or in dark corners.

- We use RFID blockers* for all our credit cards.

Please note: Even if you take all these points to heart – shit happens (sometimes at least). Scammers and rip-off artists always come up with something new. So far, though, we've always been on the safe side with this and haven't had any bad experiences yet.

Never let South Africa credit card out of your sight!

No matter what the staff in the restaurant, supermarket or wherever tries to make you believe, never let your credit card for South Africa out of your sight! It is not even about the fact that the card is stolen, but that you may not see what happens to the card.

Credit cards can be quickly copied and the data read in careless moments with the right means. This is often only noticed much later – with the next credit card statement or when the bank blocks the card for safety reasons due to conspicuous behavior.

Withdraw small amounts

Pick up what you need. As a rule, these should be rather small amounts up to 150 or 200 euros. If the wallet is lost or a thief actually helps himself, the damage is manageable. In South Africa, this is especially true for confusing, bustling and urban areas, such as Pretoria, Johannesburg, Durban or Cape Town.

We actually only withdraw significantly more money when we need the cash for a tour, a rental car or accommodation – in other words, when the large amount of cash is also spent quickly.

Tip: In parts of the country where you feel unsafe, take off during the day only. Security is a very important issue in South Africa and locals who work in your accommodation can often give you good tips – also about withdrawing money. We have had consistently good experiences with this approach and have always trusted the recommendations of the locals.

Loss, theft or similar – what now??

Whether your card is swiped from an ATM, stops working, is lost or stolen, in the end there is only one sensible option: call the bank's emergency number or 24-hour hotline as soon as possible.

If the card is still in circulation and functional, you should first have it blocked. Afterwards, you can discuss the further procedure with the consultant by telephone.

In our experience, a good solution has been found for every case so far, and the advisors usually know how to deal professionally with the relevant situations.

- Hanseatic: +49 (0) 40 600 096 422

- Barclaycard: + 49 (0) 40 890 99-877

Visa or Mastercard – which is better in South Africa?

Whether Visa or Mastercard is basically the same. Both are accepted by most ATMs (automated teller machines), hotels and online booking portals worldwide. The credit cards we recommend for South Africa are Visa Cards, which were accepted everywhere during our trip.

However, during further research we came across hints that Mastercards can sometimes cause problems in South Africa. Therefore, we advise you for a trip to South Africa quite specifically to the Visa Card.

Apply for a credit card in time

Applying for a credit card online is quite quick. However, until the data is verified, the card is produced and you finally have it in your hands, it can sometimes take a few weeks, depending on the workload and size of the bank.

It is therefore better to apply for your credit card for South Africa a little earlier – we recommend at least one to two months before the start of your trip. This way you are 99 percent on the safe side.

Banks in South Africa

- ABSA Bank

- First National Bank of Southern Africa

- Nedcor Bank

- The Standard Bank of South Africa

All these banks have ATMs where you can withdraw money. In addition, in tourist areas you can sometimes find exchange offices that will change the Euros you bring with you into Rand.

Taking cash to South Africa – sensible?

What is the alternative to the South Africa credit card? Clear cash! For many people, it is still a matter of course to take heaps of euros with them and exchange them on the spot. But is it really necessary? In no case!

For emergencies it makes sense to have a few bills with you, but as a rule the amount should be kept within limits. In our eyes, it is simply too dangerous to travel around the country with several thousand euros in cash. We prefer to spend more money than less once.

There are also visa regulations that require proof of cash upon entry.

Exchange cash

If you want to exchange cash, you can do it easily in South Africa. However, currency exchange offices are not very common and often you can only exchange in banks.

Tip 1: Change as little as possible after arrival at the airport. The exchange rate is often pretty lousy. You'll find much fairer rates outside the airport at individual bank branches. Of course, you can also compare here and possibly get out a few euros. 🙂

Tip 2: Do not exchange your money in Germany under any circumstances! Exchange rates back home are even worse.