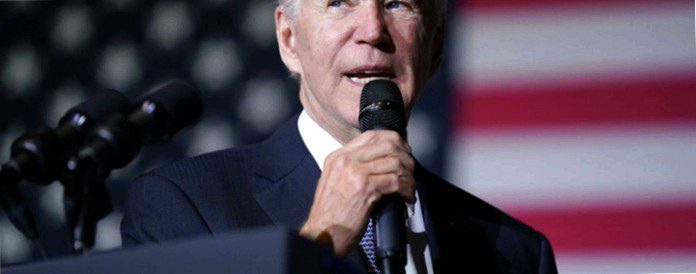

EXPLANATORY NOTE: Where does student loan forgiveness stand?

A federal appeals court in St. Louis has created another hurdle for President Joe Biden's plan to give millions of borrowers each up to 20.000 dollars in federal student loans to be forgiven .

The court on Monday agreed to a preliminary injunction stopping the program in one of several cases challenging the debt relief plan.

With the forgiveness program suspended, millions of borrowers wonder if they will even receive debt relief. The fate of the plan will likely eventually end up in the Supreme Court.

Here's where things stand:

HOW THE FORGIVENESS PLAN WORKS

The debt forgiveness plan announced in August would forgive student loan debt in the amount of 10.Eliminate $000 for those who receive less than $125.000 earning, or households with incomes of less than 250.000 USD. Pell Grant recipients, who typically have higher financial need, would receive additional debt forgiveness of 10.000 USD received.

College students qualify if their loans were paid off before the 1. July were disbursed. Under the plan, 43 million borrowers would be eligible for some debt forgiveness, with 20 million having their debt forgiven entirely, the administration said.

The Congressional Budget Office has announced that the program will cost about $400 billion over the next three decades.

The White House said 26 million people have applied for debt relief, and 16 million people have already had their debt relief approved.

A HOLD ON THE PLAN IS EXTENDED

The ruling was handed down Monday by a three-judge panel of the 8. U.S. Court of Appeals in St. Louis liked that an effort by the Republican-led states of Nebraska, Iowa, Kansas, Missouri, Arkansas and South Carolina considered blocking the loan forgiveness program.

The ruling by the panel, which is made up of three Republican appointees – one was appointed by President George W. Bush and two of President Donald Trump's appointees – is in effect until the matter is resolved in court. Previously, the court had temporarily suspended it .

Nebraska Attorney General Doug Peterson, a Republican, said in a statement that the ruling "recognizes that this attempt to forgive over $400 billion in student loans threatens serious harm to the economy that cannot be undone".

White House press secretary Karine Jean-Pierre said the administration is confident in its legal authority for the student debt relief plan.

"The administration will continue to fight these baseless lawsuits from Republican officials and special interests and will never stop fighting to support working Americans and the middle class," said Jean-Pierre.

TEXAS JUDGE FOUND BIDEN TO BE OVERREACHING

On Thursday, U.S. District Judge Mark Pittman – an appointee of former President Donald Trump based in Fort Worth, Texas – ruled that the program usurped Congress' power to enact laws . The administration immediately appealed.

Pittman said the Higher Education Relief Opportunities for Students Act of 2003, commonly known as the HEROES Act, did not provide authorization for the loan forgiveness program.

The law allows the Secretary of Education to waive or modify the terms of federal student loans in times of war or national emergency. The government said the COVID-19 pandemic created a national emergency.

But Pittman said such a massive program would require clear congressional authorization.

The plan faced other legal challenges. In October, Supreme Court Justice Amy Coney Barrett rejected an appeal from a Wisconsin taxpayer group. A federal judge had previously dismissed the group's lawsuit, finding that they did not have the legal right or authority to bring the case.

TEXAS RULING WAS A BLOW TO THE PLAN

Pittman's ruling nullifies the underlying legal argument used to justify Biden's plan. Previously, the White House was able to dodge legal attacks in court cases by tweaking details of the program.

A lawsuit argued that automatic debt forgiveness would cause borrowers to pay higher taxes in states that impose a tax on forgiven debt. The administration responded by allowing borrowers to opt out. Another lawsuit alleged Biden's plan would harm financial institutions that generate revenue from certain types of federal student loans. The White House responded by removing those credits from the plan.

However, the Texas ruling argues that the HEROES Act does not grant authority for mass debt forgiveness. The law grants the Department of Education great flexibility in national emergencies, but the judge ruled that it was unclear whether the debt relief was a necessary response to COVID-19, noting that Biden had recently declared the pandemic over.

THE CASE IS HEADED TO THE SUPREME COURT?

The legal situation is complicated because of the numerous lawsuits. It is likely that the Texas case and the lawsuit filed by the six states will be appealed to the Supreme Court. Before it reaches that level, the appellate courts of the 5. and 8. county – both dominated by conservative judges – decide separately in each case.

The case before the 8. District could soon land in Supreme Court after panel grants injunction sought by six GOP-led states.

Likewise, the government has signaled that it will appeal the Texas ruling. If the 5. U.S. appeals court asked to block Pittman's ruling pending appeal, losing side could appeal to Supreme Court.

In both cases, the appellate courts would not make a final decision on the validity of the program, but on whether it can continue while the challenges continue.

Meanwhile, the Biden administration is no longer accepting applications for student loan forgiveness.