Exclusive: Russian officer reveals why he risked everything to stop Putin’s war in Ukraine

"We were dirty and tired. People around us died. 'I didn't want to feel like I was a part of it, but I was,' official told CNN.

"We were dirty and tired. People around us died. 'I didn't want to feel like I was a part of it, but I was,' official told CNN.

The leverage effect tells us the effect of debt capital on the profitability of equity capital. With the use of debt capital, instead of equity capital, the return on equity of the owners can be increased.

A positive leverage effect requires that the return on investment,i.e., a company's return on assets, must be higher than the interest rate on borrowed capital. This means that the company achieves a return of 10 percent with its operating activities, as an example in automotive construction, which is higher than, for example, the interest on borrowed capital at 5 percent for the bank loans taken out by the company.

However, the leverage effect is limited by restricted borrowing possibilities, as well as

increasing interest rates with high indebtedness and due to lack of investment opportunities.

An example of return on equity is:

A company in the real estate industry has on its balance sheet on the asset side only one rented property worth 1 million euros. The company finances itself entirely with equity capital.

When you apply for a loan, a contractual agreement is reached in case of a positive decision by the lender. The credit agreement or loan agreement is set out in writing and signed by both parties. In the contract all agreements are contained to the credit. This means that the loan amount, the interest, the repayment, possibilities and reasons for cancellation as well as all ancillary loan costs must be included.

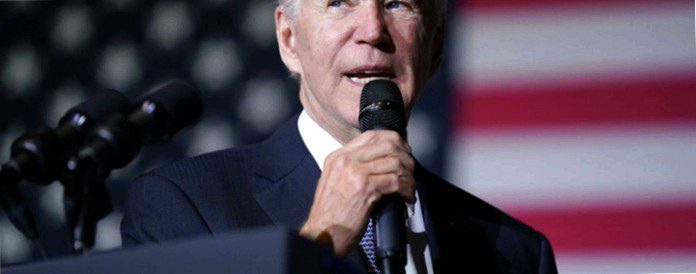

A federal appeals court in St. Louis has created another hurdle for President Joe Biden's plan to give millions of borrowers each up to 20.000 dollars in federal student loans to be forgiven .

A loan for the self-employed is a very helpful, but for the target group in many cases unfortunately also associated with major hurdles financial injection. Thus, there are many conditions and requirements that must be met in order to be granted a loan for the self-employed, the conditions of which are as acceptable as possible. Here on STERN.Here we show you how it can still work, go into the specifics of such financing and of course you have the opportunity to use the free loan comparison and find a suitable offer with a click of the mouse.

Perhaps you have also asked yourself the question: Is a loan for self-employed without proof of income feasible? In fact, it might be rather difficult to get serious financing for your plans in this way. But of course, self-employed people generally have the option of obtaining a loan from various banks and credit institutions, as well as from independent individuals. The following types of self-employed loans exist – in parentheses are the potential providers of each genre:

The strategy of the shortest possible term for a construction financing is interesting for those builders who want to have paid off their construction financing with the available resources as quickly as possible. You can learn how to effectively pay off a construction loan in the shortest amount of time here.

Basically, the term of a construction financing is regulated by the amount of repayment and the interest saved. The higher the repayment rate, the higher the interest saved, which is paid within the framework of the respective annuity, or. do not have to be paid.

Family care time is intended to ensure the compatibility of care by relatives and professional activity. Because the majority of people in need of care are still cared for at home. The family plays an important role. Close relatives often take over the care partially or even completely. Now time flexibility allows professionals to reduce hours on the job for a specified period of time. So they have more capacity to care for family members. What you need to know about family care leave..

When care is needed, most people want to be cared for at home. But the implementation is challenging: If, for example, the children take care of their parents, they have to manage their own family life, the job and, in addition, the care. This is often more than one person can afford.

Personal finance experts sound the alarm: student loans are out of control. Some even say that increasing student debt could be the next financial crisis that leads the country into a recession.

But in a delicious turn of events, some borrowers are reversing that trend, and that's leaving some lenders feeling a little cheated.

Lease-to-own financing is a solid option for anyone who needs a computer, laptop or tablet but has either a bad credit score or no credit score at all. Lease-to-own providers like Snap Finance have different eligibility criteria that allow them to consider more than just your credit score.

How to finance electronics with bad credit? If you are not eligible for standard loans or in-store financing due to poor credit, you can apply for lease-to-own financing with a company like Snap Finance. Lease-to-own is more flexible and offers people with bad credit higher chances of approval.

According to § 130 BGB (German Civil Code), the sender of an e-mail bears the full burden of proof that the e-mail has reached the recipient. He does not benefit from the simplification of proof of the prima facie evidence by the fact that he does not receive a message about the undeliverability of the e-mail after it has been sent.

There is a dispute between the parties as to whether the plaintiff is obligated to repay a loan granted to him to finance an advanced education in the amount of 60.000 euros to repay to the defendant.