Refinance rates for 30- and 20-year mortgages close week with surprise plunge

Our goal here at Credible Operations, Inc., NMLS number 1681276, hereafter referred to as "Credible," is dedicated to giving you the tools and confidence you need to improve your finances. Although we promote products from our partner lenders who compensate us for our services, all opinions are our own.

Check out mortgage refinance rates for the 21. January 2022 on, which have been shuffled since yesterday. ( iStock )

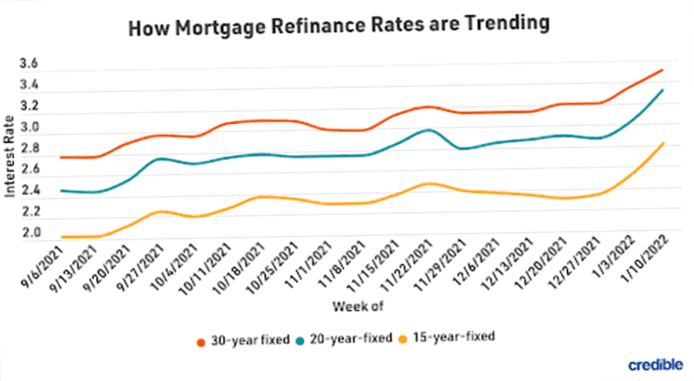

Based on data compiled by Credible, current mortgage refinance rates have fallen since yesterday for longer repayment terms, while remaining stable for shorter ones.

- 30-year fixed-rate refinance: 3.625%, down from 3.750%, -0.125

- 20-year fixed-rate refinance: 3.375%, down from 3.500%, -0.125

- 15-year fixed-rate refinance: 2.875%, unchanged

- 10-year fixed rate refinance: 2.875%, unchanged

Prices last updated on 21. January 2022. These rates are based on the assumptions shown here. Actual rates may vary.

Despite gradual gains since last week, mortgage refinance rates slipped unexpectedly today for 30-year and 20-year repayment terms. With 20-year rates at the bargain level of 3.375% and 15- and 10-year rates hovering around 2.875% for the third day in a row, homeowners could realize interest savings by refinancing to one of these terms. Homeowners who took out mortgages at higher interest rates can also save with a 30-year refinance.

These rates are based on the assumptions shown Here. Actual rates may vary.

If you're thinking of refinancing your home mortgage, consider using Credible. Whether you want to save money on your monthly mortgage payments or consider refinancing with a payoff, Credible's free online tool lets you compare interest rates from multiple mortgage lenders. You can see pre-qualified rates in as little as three minutes.

Current 30-year fixed refinance rates

The current rate for a 30-year fixed-rate refinance is 3.625%. This is down from yesterday. Refinancing a 30-year mortgage into a new 30-year mortgage could lower your interest rate, but may not have much impact on your overall interest costs or monthly payments. Refinancing a shorter-term mortgage into a 30-year refinance could result in a lower monthly payment but higher overall interest costs.

Current 20-year fixed refinance rates

The current interest rate for a 20-year fixed-rate refinancing is 3.375%. This is from yesterday down. By refinancing a 30-year loan into a 20-year refinance, you can secure a lower interest rate and reduce your overall interest costs over the life of your mortgage. However, you can get a higher monthly payment.

Current 15-year fixed refinance rates

The current interest rate on a 15-year fixed-rate refinance is 2.875%. This is the same as yesterday. A 15-year refinance could be a good choice for homeowners looking for a balance between lowering interest costs and maintaining a manageable monthly payment.

Current 10-year fixed refinance rates

The current interest rate on a 10-year fixed-rate refinance is 2.875%. That's the same as yesterday. A 10-year refinance will help you pay off your mortgage sooner and maximize your interest savings. But you could also end up with a higher monthly mortgage payment.

You can explore your mortgage refinance options in minutes by visiting Credible to compare interest rates and lenders. Check out Credible and qualify today.

Prices last updated on 21. January 2022. These prices are based on the assumptions shown Here. Actual rates may vary.

Is now a good time to refinance?

Mortgage refinance rates have been at historic lows throughout the year. It's unlikely they'll go much lower, and it's very likely they'll start to rise in the coming months. But low interest rates aren't the only factors that determine whether now is a good time for you to refinance your home loan.

Everyone's situation is different, but in general, it may be a good time to refinance if:

- You can get a lower interest rate than you currently have.

- Refinancing will save you money over the life of your home loan.

- Your savings from refinancing will eventually exceed closing costs.

- You know you will stay in your home long enough to recoup the refinancing costs.

- You have enough equity in your home to avoid private mortgage insurance (PMI).

If your home needs significant, costly repairs, it may be a good time to refinance to take out some equity to pay for those repairs. Keep in mind, however, that lenders generally limit the amount you can take out of your home when refinancing with a payoff.

How to get your lowest mortgage refinance rate

If you are interested in refinancing your mortgage, improving your credit score and paying off other debt could secure you a lower interest rate. It's also a good idea to compare interest rates from different lenders if you're hoping to refinance so you can find the best rate for your situation.

According to a study by , borrowers can save an average of 1 during the life of their loan.Save $500 if they buy just one additional interest rate quote, and average 3.000 USD when they compare five interest rate offers Freddy Mac.

Be sure to shop around and compare rates from multiple mortgage lenders if you decide to refinance your mortgage. Credible's free online tool makes it easy to do this and view your pre-qualified rates in just three minutes.

How Credible calculates refinance rates?

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the development of mortgage refinancing rates. Credible average mortgage refinancing rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The interest rates assume a borrower has a credit score of 740 and is borrowing a conventional loan for a single-family home that will be his or her primary residence. Rates also require no (or very low) discount points and a 20% down payment.

Credible mortgage refinance rates only give you an idea of current average rates. The rate you receive may vary based on a number of factors.

What is the average cost of a refinance?

Refinancing a mortgage can result in significant interest savings over the life of a loan. But all these savings are not for free. In general, there are costs – an average of 5.000 US dollars Freddy Mac – in refinancing your mortgage.

Your exact refinancing costs will depend on several factors, including the size of your loan and where you live. Typical refinancing costs are:

- The cost of registering your new mortgage

- Assessment Fees

- Attorney fees

- Lender fees, such as origination or underwriting

- Title Service Fees

- Credit report fees

- Mortgage points

- Prepaid interest fees

Remember that there is no really free refinancing. Lenders who market "free loans" typically charge a higher interest rate and pass the cost onto the loan – meaning you'll pay more interest over the life of the loan.

Credible also has a partnership with a home insurance broker. You can compare free home insurance quotes through Credible's partner here. It is fast, easy, and the entire process can be completed entirely online.

Think it might be the right time to refinance? Be sure to shop around and compare interest rates at several mortgage lenders. With Credible, you can do this easily and see your pre-qualified rates in just three minutes.

Rates last updated on 21. January 2022. These rates are based on the assumptions shown Here. Actual prices may vary.

Have a financial question but don't know who to contact? Send an email to the Credible Money Expert at [email protected] and your question may be answered by Credible in our Money Expert column.

As a credible authority on mortgages and personal finance, Chris Jennings has covered topics such as mortgage loans, mortgage refinancing and more. He has been an editor and assistant editor in the online personal finance department for four years. His work has been featured by MSN, AOL, Yahoo Finance and others.