The relationship between firms and governments in the corona pandemic

In the event of a disaster, public finances play a key role when there are spillover effects of credit risk between eurozone governments and national companies

How do sovereign credit risks relate to those of domestic firms? Given house-sized corporate and government debt in advanced economies, it is important from an academic and policy perspective to understand this relationship comprehensively. For financial firms, and banks in particular, the fundamental characteristics of these active mechanisms are driven by the so-called "doom loop," the negative spiral that can occur when banks threatened with insolvency hold government bonds and governments with weak public finances bail out these banks. (cf., z. B., Acharya et al., 2014; Brunnermeier et al., 2016; Farhi and Tirole, 2018).

Moreover, empirical research has shown that credit risks are transferred between the state and the national non-financial sector (cf., z. B., Lee et al., 2016; Almeida et al., 2017). This research soberingly shows that an increase in sovereign risk negatively affects the ability of firms to repay debt, and thus their creditworthiness. Generally, these effects are thought to be magnified in states with already low fiscal space and high credit spreads because: These states have concerns about higher corporate taxes in the future as credit conditions deteriorate and anticipate a general impairment of the legal, political, and economic framework (Corsetti et al., 2013; Augustin et al., 2018).

In a recent SAFE Working Paper (Jappelli, Pelizzon, and Plazzi, 2021), we contribute to a deeper understanding of credit markets through three insights. First, we find a more intense credit risk relationship between companies and governments (company-state nexus) during corona pandemic outbreaks only in countries with large fiscal room for maneuver. This result remains true even when accounting for diverse firm and country characteristics. Direct econometric tests point to the prominent role of public finances by pricing in expected government support, as reflected in forward-looking market prices.

Our second insight consists of developing an asset pricing model that takes into account the statistical probability of a rare catastrophe. In this model, government aid acts as a limit on the extent of disaster on corporate default risk. The model allows us to translate fiscal agency to the pricing of corporate entitlements. Finally, we use a synthetic control approach and determine the model-based share of government aid from core and peripheral states during pandemics. This allows us to quantify how the strength of public sector budgets affects the pricing of corporate credit risk and their cost of capital.

Our conclusions are based on a daily sample of credit default swap spreads covering large nonfinancial firms and their sovereigns in nine countries within the European Union from January 2019 to September 2020, along with firm- and country-level data on stock returns and controls. We divide countries into two groups: five core countries, with relatively high fiscal capacity (Belgium, Finland, France, Germany, and the Netherlands), and four peripheral countries, with relatively weak budgets (Italy, Greece, Portugal, and Spain), although the results hold even with disaggregated data. All of these EU countries responded to the pandemic shock during the test period under consideration with similar economic shutdowns and simultaneous aid to households and nonfinancial institutions. The exogenous and unexpected re-pricing caused by the disaster allows us to trace how things evolved. In the cross-section, our focus on the EU provides us with an ideal setting in which monetary policy, exchange rates, and pandemic affect are homogeneous.

What drives credit risk synchronization?

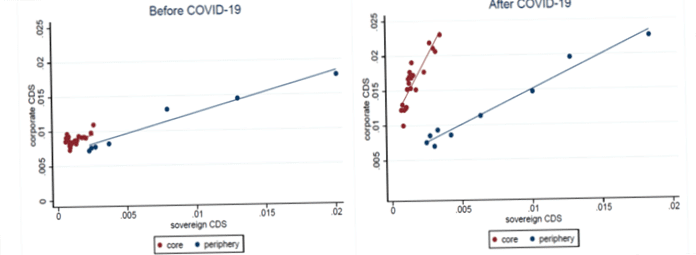

Figure 1 depicts the first step of our investigation by showing the relationship between government and corporate CDS spreads at the time of the pandemic using a clustered scatter plot. All observations are grouped into equal-width sections. The data points in the graph reflect the average values of corporate and sovereign returns within each section. The top chart refers to the sample preceding the corona pandemic in time (from 1. January 2019 to 23. February 2020), while the one below illustrates the situation during the pandemic. Two conclusions emerge from both figures combined. First, unique data clusters form in each plot, consistent with the classification of core and peripheral countries. Second, the pandemic appears to have been accompanied by a slight deepening of the CDS spread relationship in peripheral countries, but a much greater deepening in core countries. First, then, all the evidence suggests that the pandemic outbreak has had a significant impact on the overall movement of credit risk in fiscally strong countries.

Figure 1: Concurrent credit risk: This figure shows corporate and sovereign CDS spreads per unit at par in a clustered scatter plot, before and after the corona shock (top and bottom figures, respectively). The observations are first grouped into equal sections. The data points in the graph correspond to the average values of the variables on the x-axis and the y-axis within the sections.

To formally test whether this result also holds as a function of a number of factors, we resort to a panel regression model in which corporate CDS spreads are the dependent variable. This makes it possible to leverage the granularity of the data and determine the relationship between corporate and sovereign CDS spreads as a function of aggregate and corporate controls. In addition, and specifically through the shock of the Corona crisis, corporate credit risk responded directly to the state decision to impose national lockdowns that fully or partially halted certain economic activities, so it is natural to consider the former as the outcome variable.

Adapted from Acharya et al. (2014), we work with the daily growth rates of credit default swaps; more specifically, the first differences of log CDS spreads of sovereigns and firms. This setup increases the stationarity of the data, as credit default swaps are highly persistent on a daily basis. Moreover, it is more appropriate for a panel of firms and countries that differ in the level of spreads. Therefore, we determine interconnectedness using the sensitivity (the elasticity) of a firm's credit risk to the credit risk of its domestic sovereign. We use this to determine the extent of risk transfer from firm i and state j in a daily panel regression model. In our differences-in-differences approach, we link all independent variables to a dummy variable that is observed during the pandemic (all days after the 24. February 2020) takes the value of one and zero otherwise, and compute the model separately for core and periphery countries. Our results suggest that the corona pandemic has had a huge impact on the firm-state nexus only for firms in core states. The calculations suggest that the credit spreads of these firms were virtually twice as sensitive to shocks in the credit spreads of the corresponding sovereigns during the crisis period, raising the general impact to the level of about 0.25 – accordingly, a ten percent increase in sovereign spreads in the second half of the sample leads to an expected 2.5 percent increase in spreads for corporate sector debt.

Remarkably, this figure is consistent with that of firms in peripheral countries, for which the additional contribution of the Corona sample is a meager 0.052 (not statistically significant). In summary, the concurrent increase between corporate and sovereign credit risk was economically and statistically significant only in core countries. In peripheral countries, sensitivity was already at high levels even before the pandemic and did not change noticeably afterwards. Considering that our sample includes nonfinancial firms with a combined market share of €3.25 trillion – about 56 percent of the EU market – the economic magnitude of this effect should not be underestimated.

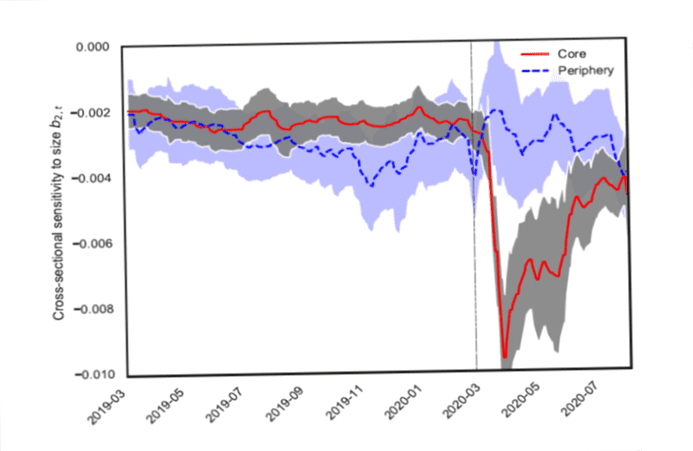

This result suggests that a "government support channel" is a determinant of the post-pandemic firm-state nexus, which views transmission effects as a result of expectations of public liquidity and guarantee of solvency. Overall, our data show that the reassessment of credit risk in the face of the shock led to a closer relationship between firms and sovereigns in countries that were better able to provide public support. Market expectations of government financial support are a key determinant of the cost of financing for domestic firms when systemic tail risk materializes, i.e., the high risk posed by unpredictable events. The result is robust to the inclusion of a host of country and firm characteristics that express vulnerability to the shock – such as z. B. the severity of foreclosure measures and the degree of trade openness of sovereigns, as well as the liquidity and financing structure of firms-and, in various econometric tests. Figure 2 shows that when the Corona shock erupted, actual CDS spreads were priced at a discount to projected spreads only for large companies in core EU countries.

Figure 2: Deviations of CDS from fundamental credit risk as a function of their size: we compute the model-implied CDS rate from Merton's (1974) model and estimate regressions of CDS spreads on the spread, size, and leverage predicted by the Merton model, separately for core and peripheral countries. The graph shows the trailing average of the time series of the estimated coefficient on the one standard deviation variable. The dashed vertical line indicates the 24. February 2020.

Building on Gandhi et al. (2020), we propose a theoretical framework to understand how the size of sovereign support affects the relationship between sovereign and corporate credit risk in the face of a rare catastrophe. In our model, a disaster elicits a negative jump in consumption as well as an increase in corporate credit risk due to a higher probability of default by nonfinancial firms. The government can provide collective guarantees by capping the level of developments, thereby limiting the increase in the level of credit default premiums. Once the guarantee is in place, however, the risk of default on public debt increases, equal to the share of the shock absorbed by the state. The model predicts that the business-state nexus is stronger in countries where the government is better able to shield corporate credit risk with government guarantees,. These are the countries where governments appear to have greater fiscal space. We apply the model through the synthetic control approach of Abadie et al. (2010) on the data, allowing us to identify the effect of guarantees on CDS pricing. We calculate an estimate of about 2.6 times for the model risk-adjusted ratio of government support to core to peripheral countries as priced into credit markets over the medium term.

Macroeconomic implications

Our results have far-reaching implications for the debate on the merits of fiscal agency. Most recently, Blanchard (2019) argues that high sovereign debt in a low interest rate environment is not necessarily associated with high fiscal costs. However, we find that government fiscal space has a positive effect when markets process information efficiently, as capacity buffers for spending through disaster-related repricing translate directly to corporate risk. Ultimately, this effect lowers the credit spreads – and thus the cost of capital – of firms located in fiscally stable countries and strengthens their resilience.

Ruggero Jappelli is a doctoral student at SAFE in the Financial Markets Research Department.

Alberto Plazzi is Professor of Finance at the Universita' della Svizzera italiana (Lugano).

Blog posts represent the personal views of the authors and not necessarily those of SAFE or its staff.