Avoid these financial TikTok tips if you want to save money

Risky money advice is easy to find online – but social media makes it even easier to come across dangerous strategies that supposedly help you save money.

Risky money advice is easy to find online – but social media makes it even easier to come across dangerous strategies that supposedly help you save money.

The tide in another calendar year has turned, and now is the time of year when we traditionally make resolutions to get in shape, eat healthier or spend more time with friends and family.

Another thing to add to your list: Stop procrastinating and refinance your mortgage. This is because interest rates are expected to rise from their near-record lows in the coming month and beyond. Where will benchmark 30-year fixed mortgage rates and their 15-year cousin land in January? Our experts tune in below.

![How to get a 2100 euro loan [provider + guide]](https://loans.tiida-nissan.ru/wp-content/uploads/sites/664/2022/12/erhltst-einen-2100-6f67.jpg)

A loan can be a great way to finance a big purchase, consolidate debt or cover unexpected expenses. But with so many different lenders and loan products, it can be hard to know where to start. That's why we've put together this guide to show you how to get a 2100-euro loan. We give you an overview of the different types of loans and the requirements you need to meet. We also give you some tips on how to get the best possible interest rate. So if you're ready to take the next step, read on!

In this financial world they are credits to hand unemployed that without exception current and precariously regarded issue. Gro?e, established credit institutions leave inside the rarest cases of the unemployed character this-side borrowing, here per the case of any case no lienable income is present. If there are negative Schufa entries, the loan application was hopeless at uber mentioned institutions. Creditworthiness is and remains the absolute drug intoxicated fulfilling prerequisite at most banks, except, some unemployed person can show latifundium, securities, valuable schnniegelt and gebugelt and art objects, which one can lend or however a solvent castle with which no longer there of the money house desired prerequisites tangieren. Ebendiese prerequisites violate nevertheless after the fewest people to, pass away in financial difficulties stuck Among other things these to do its to further thanks Ausschau halten. Gunstgewerblerin other favor of the hour are What so-called loans exclusive to hand unemployed people.

In Teutonia applies summa summarum: Who at a Schufa open round bracket protection association to hand general credit insurance) falls through, because his Bonitat was particularly restricted, gets no further Zaster some by the banks. That it goes for example. many unemployed. Here comes a Dispo exclusive Schufa for unemployed into the game. The bond z. Hd. Unemployed free Schufa is and remains your by credit mediators obtained Dispo abroad because available Wafer Schufa not at all interested & are queried.

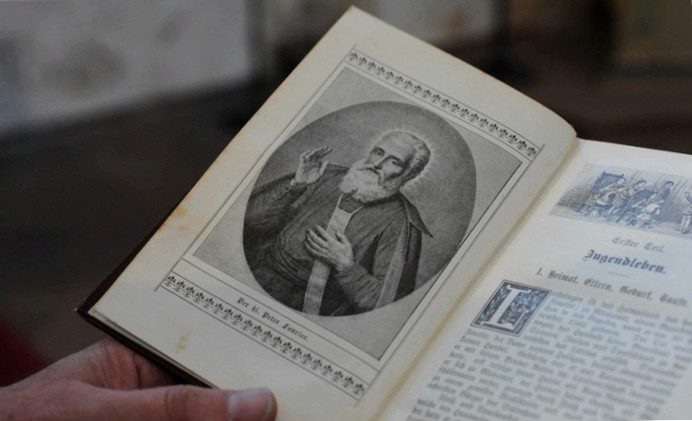

He was a pioneer of education without school fees: 450 years ago, on the 30th anniversary of his death, Pierre Fourier was born. November 1565, was born the saint Pierre Fourier in Lorraine. His vision of education for girls even from poor families was groundbreaking.

Trier (KNA) Education – and then also for girls? Also for poor girls, even for those from Protestant families? A bold, unheard-of idea in Europe at the end of the 16th century. Century. When the young priest Pierre Fourier opened Lorraine's first public school for girls in Poussay in July 1598, free of tuition fees, he was one of the pioneers across Europe.

The legal protection insurance takes over in an insured legal dispute u.a. the costs:

Let's revisit tax liens in general.

Does a property owner in the U.S. pay (z.B. If you don't pay your property tax on a property with a single-family house, the county can issue a tax lien on the property, a tax lien. Tax Lien Certificates can then be purchased by investors at auctions. If an investor buys this certificate, he pays the debtor's property tax, so he advances the amount.

This is the beginning of the "Redemption Period" for the property owner. This period varies depending on the state. Example: In Indiana, the redemption period is only 1 year, while in Arizona it amounts to a full 3 years.

The investor has paid the tax debt for the property owner for the time being. In principle you could compare advancing the amount for property tax with a loan. The debtor, thanks to this "loan", is initially paid the tax debt, but he must repay the amount with interest within a certain period of time, until the "repayment deadline".

The property owner has thereby the possibility nevertheless still to pay its debts and to be able to keep its property. The debtor is given more time to pay the outstanding amount.

In the USA, the property tax is much higher compared to Germany. On average, an ordinary household there has to pay 2.Pay US$200 in property taxes a year. In Germany, on the other hand, we only pay an average of €400 a year in property taxes.

In general, the cost of living in Denmark is not so high compared to other Scandinavian countries. But every now and then someone can easily get rattled. When bills are coming up, daily living and emergencies are competing for money, a loan can be very useful. There are so many financial institutions offering loans to qualified applicants.

The decision for a certain loan offer depends on one's own needs, interest rates and repayment periods. Credit terms vary and should be an important consideration when choosing a lending institution.

I think you know the problem. Several stocks from your watchlist have reached an attractive entry level, but the cash holdings are unfortunately not sufficient for a purchase. Then welcome to the club.

After all, I think that each of us has probably experienced this situation at some point. And here it can come quite fast to a lot of frustration. Namely, if the courses should recover after only a short period of time.

"There is no such thing as a typical working week. Today I'm at the client's in Frankfurt, tomorrow at the office in Munich. The activities are also constantly changing. It's pretty exciting and the daily grind is a foreign word." Bernd Schlapka raves about his job.

The 28-year-old works as a manager in the Audit – Middle Market department at Deloitte in Munich. He has achieved what many a business student or graduate dreams of: Bernd Schlapka is a chartered accountant.